utility for service tax return

The Service Tax return is required to be filed by any person liable to pay the Service Tax. E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries.

Tax Season And You Resources For People With Vision Loss Second Sensesecond Sense

Utility Tax Service LLC was established in October 2004 and we are committed to providing our clients with the highest quality service in the property tax industry.

. Learn how to pay your business taxes or apply for a business license in Seattle. Enter the details in the form ST-3. The last date of filing the ST-3ST3C return.

Utilities for e-filing Service Tax Returns ST-3 ST3C for the period October 2016-March 2017 are now available in both offline and online version. The service tax return is required to be filed by any person liable to pay the service tax. Service Tax Return ST-3 for the period April -September 13 is now available in ACES for e-filing by the assesses in both offline and online version.

Check your refund status make a payment get free tax help and more. The last date of filing the ST-3 return for the said. Go to slide 2.

1800 103 0025 or. Enter on this line the credit against the Utility Tax for the new Lower Manhattan relocation and employment assistance program. Go to slide 1.

Download Utility Services Tax Return - Gross Income CT-186-P-I Instructions Department of Taxation and Finance New York form. Assessees can file their Central Excise and Service Tax Returns using following offline Excel UtilitiesXML Schema by downloading the same from this page. Currently we represent over.

Download the IRS2Go app. Business Taxes Information about business taxes. The last date of filing the.

IR-2022-190 October 27 2022 The Internal Revenue Service urges the nations more than 750000 active tax return preparers to start the upcoming 2023 filing season. Click Service Tax and Enter your User Name and Password. It may be a flat tax or it may be based on the residents usage.

Download Utility Services Tax Return - Gross Income CT-186-P Department of Taxation and Finance New York form. Attach Form NYC-98UTX IMPOSITIONBASISRATE OF. Utility for e-filing Service Tax Return ST-3 for the period October 2015 March 2016 is now available in both offline and online version.

The last date of filing the ST-3. Select the premises for which return is filed. It is advised that the latest Excel Utility may be used.

Download ST3 Return Utility for Oct to Mar 14 Service Tax Return Filing. E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries. 2007-2021 Utility Tax Service LLC.

Service Tax Return ST-3 for the period Oct13 -March14 is now available for e-filing by the assessees. Assessees can file their Service Tax Return ST-3 using following offline Excel Utilities by downloading the same from this page. File a Damage Claim.

The person liable to pay Service Tax should himself assess the Tax due on the Services provided. Service Tax Return ST-3 for the period April14 September14 is now available for e-filing by the assesses in both offline and online version. Please contact the tax office if you have any questions.

1800 103 0025 or. Assessees can file their Central Excise and Service Tax Returns using following offline Excel UtilitiesXML Schema by downloading the. Omnibus operators subject to nys department of public service supervision.

Browse By State Alabama AL. Business Taxes and Licenses. Go to slide 3.

Download ER1 Return Excel. Utility services use tax due for the period multiply line 4 by the tax rate of 14 percent 0014. Information contained in this website is subject to change without notice.

E-file Tax In Minutes Upload.

Introduction Of Gen Income Tax Return Filing Software Sag Infotech Ca Software Development Company

Filing Taxes In 2022 Irs Deadline Tax Credits Unemployment And Tips

Utility Customer Service City Of Carrollton Tx

Irs Will Start Accepting Tax Returns Feb 12 Later Than Usual Wsj

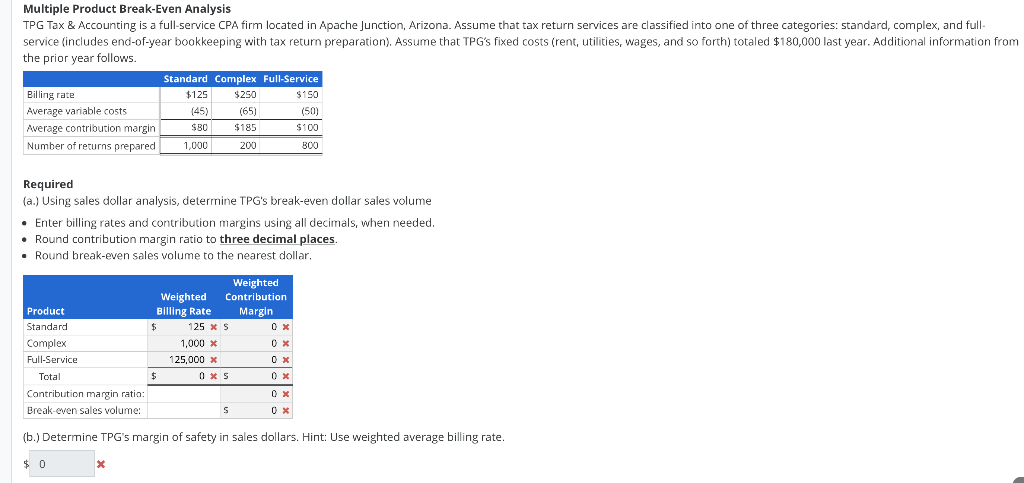

Solved Multiple Product Break Even Analysis Tpg Tax Chegg Com

Can Rent And Utilities Be Used As A Tax Deduction

City Of Collinsville Illinois Official You Will Be Able To Submit Your Application For The 2021 Utility Tax Rebate Program Beginning April 1st And Ending May 31st Facebook

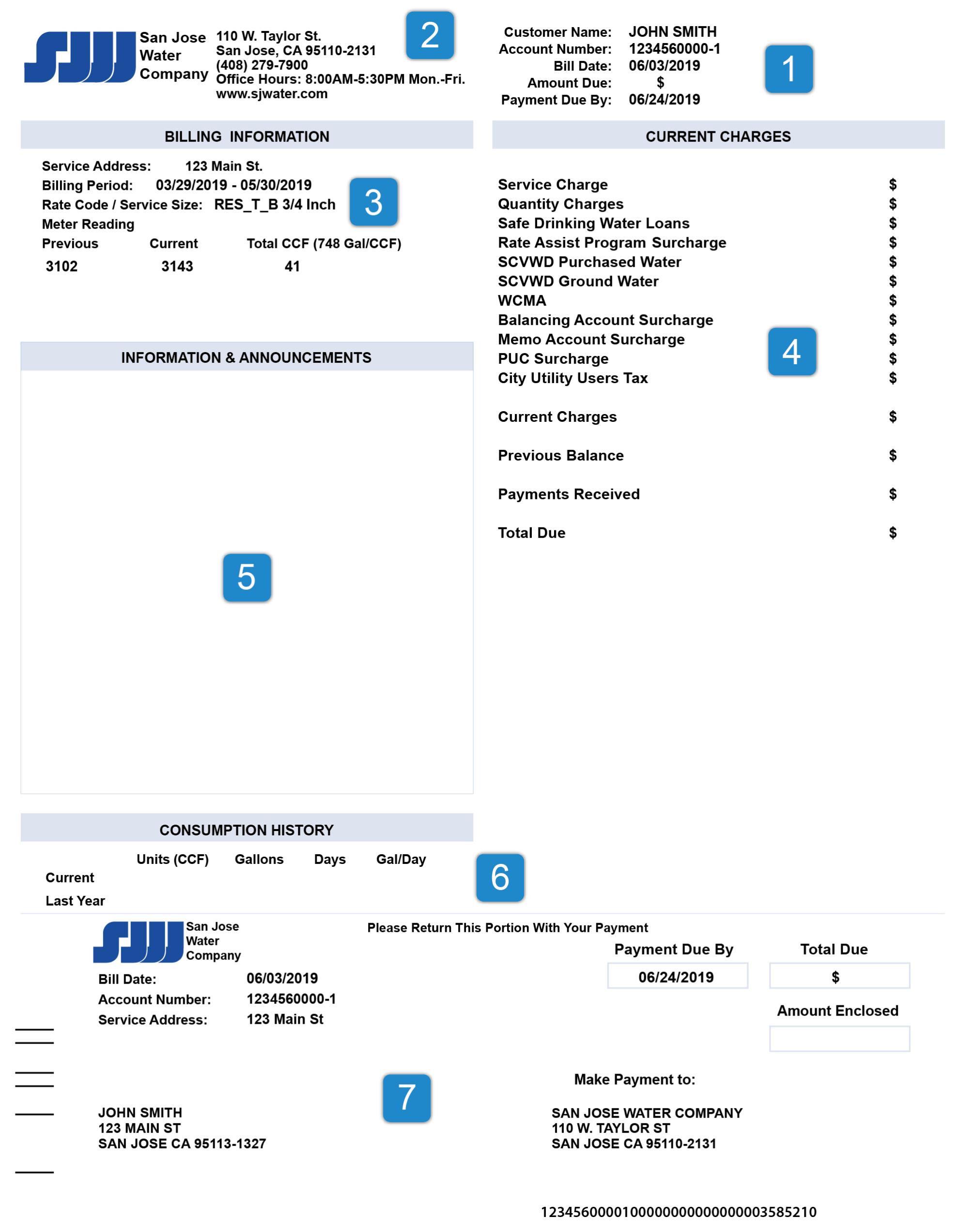

How To Read Your Bill San Jose Water

E Filing Of Service Tax Return For Apr 14 To Sep 14 Enabled Due Date 25 10 14 Simple Tax India

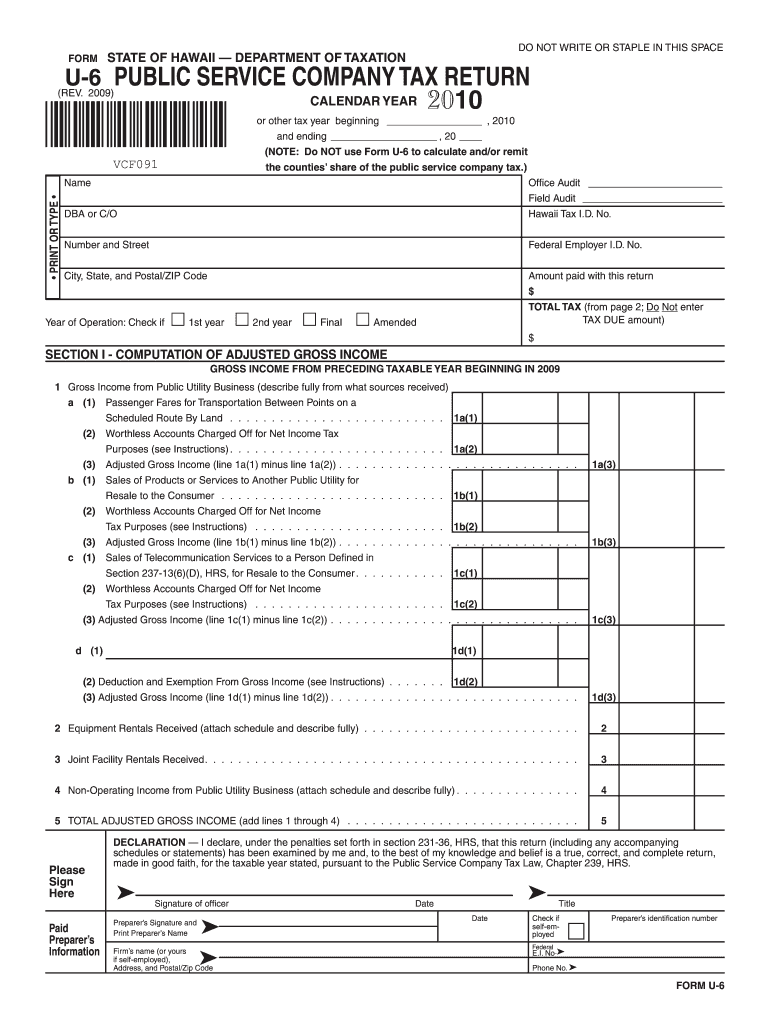

Form U 6 Rev 2009 Public Service Company Tax Return Hawaii Gov Fill Out Sign Online Dochub

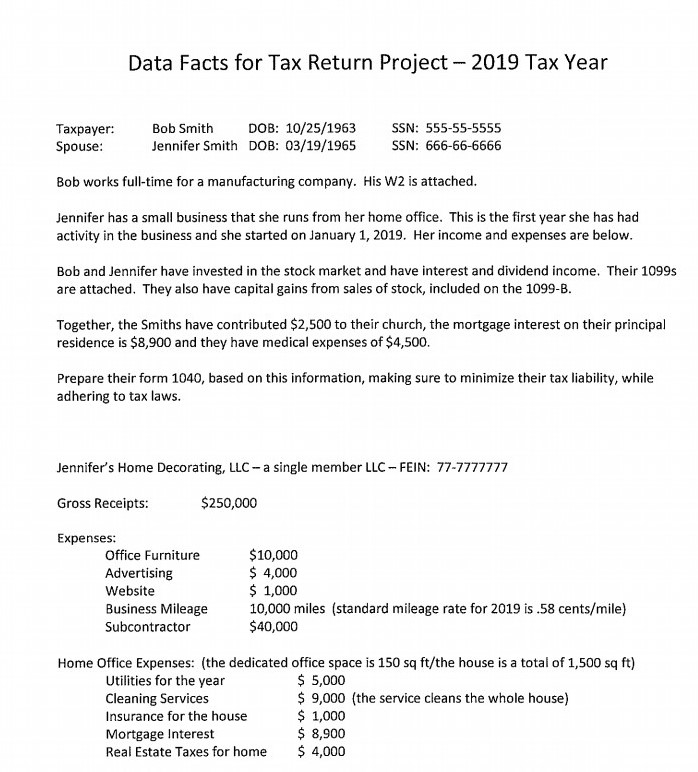

Data Facts For Tax Return Project 2019 Tax Year Chegg Com

Best Free Tax Software 2022 Free Online Tax Filing Zdnet

How To Get An Exemption Certificate In Pennsylvania Startingyourbusiness Com

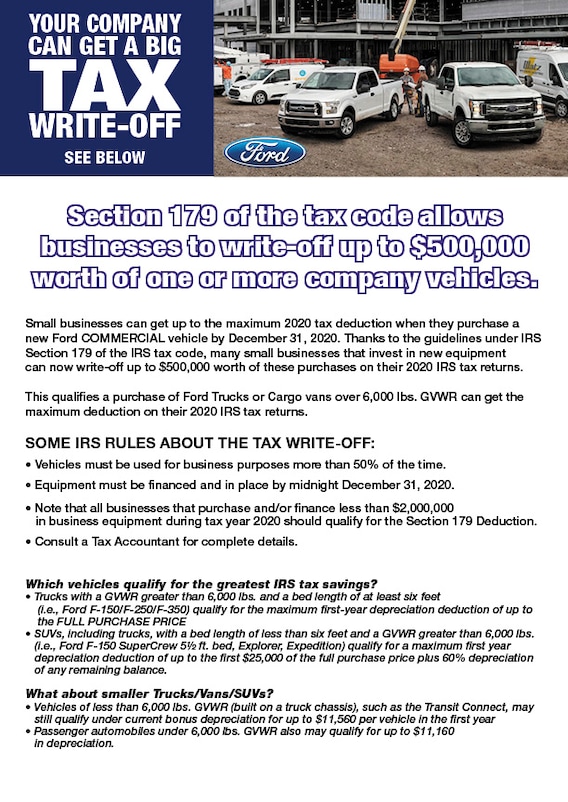

Potential Tax Break Sayville Ford

Software For Complex Tax Returns Intuit Lacerte

Service Tax And Excise Return E Filing Offline Utilities Are Now Available On The Aces Website A2z Taxcorp Llp

Due Date To File Service Tax Return 4 13 To 9 13 Is 25 10 2013 Online Offline Facility Available Now Simple Tax India